The Cornerstone of Successful M&A: Embracing Due Diligence with Confidence.

In the realm of mergers and acquisitions, due diligence stands as the critical bridge to success, safeguarding investments across all industries, not limited to the world of golf courses. This vital step ensures that every facet of the transaction is transparent, minimizing risks and setting the stage for a prosperous partnership.

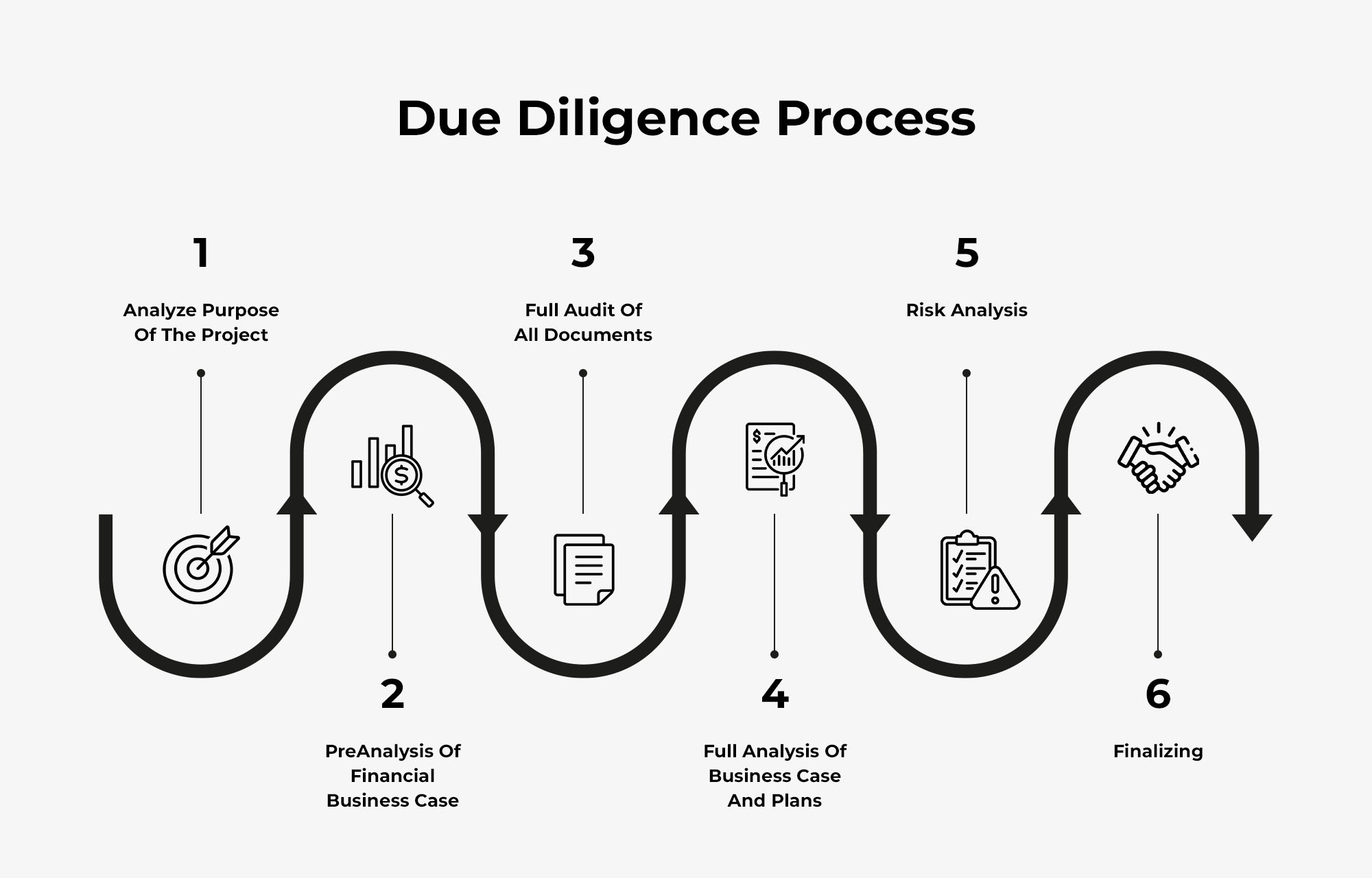

We understand that for sellers, the journey through due diligence can feel like navigating a labyrinth, with every document, asset, and team member under the microscope. It’s a detailed process that demands openness and meticulous scrutiny, from financial audits to asset evaluations and beyond. While it might seem daunting, this thorough examination is designed to shine a light on the true value and potential of your business, laying the groundwork for a smooth transition and lasting success.

Our Unique Edge

In the niche field of golf course M&A, finding seasoned experts is rare. That’s where WDC GOLF stands out. Drawing from our extensive experience in organizing top-tier golf tournaments, we bring a unique perspective to every deal, understanding the intricacies of golf course management from an insider’s viewpoint.

Expert Insights from the Fairway

At WDC GOLF, we don't just facilitate deals; we're entrenched in the very fabric of the golfing world. As seasoned organizers of prestigious golf tournaments, our hands-on experience with golf course management sets us apart. This dual perspective as both operators and consultants enables us to understand the intricacies of transactions from both the seller's and buyer's viewpoints, ensuring a nuanced approach to every deal.

The Power of Connection:

What truly positions WDC GOLF ahead in the competitive landscape is our unparalleled network. Our active involvement in the golf industry provides us with direct access to a rich tapestry of golf courses throughout Japan, along with reliable, firsthand information and valuable resources. This exclusive network is not just a list of contacts; it's a gateway to opportunities that are as unique as they are lucrative.

Step 1: Tailored Consultation

Our partnership begins with trust, symbolized by a non-disclosure agreement, safeguarding your interests. We delve into the specifics of your prized golf course, evaluating if we can meet your expectations within the dynamic landscape of the market. Our goal? To align with your desired outcome as closely as possible. Early engagement with us is crucial for optimizing your chances of selling at your preferred price.

Step 2: Strategic Due Diligence Preparation

With the decision to proceed, we craft a comprehensive checklist for due diligence, guiding you in assembling the necessary documents. Meanwhile, our quest for the perfect buyer begins, leveraging the exclusive WDC GOLF network to uncover potential matches, ensuring a seamless blend of preparation and opportunity.

Step 3: Negotiation & Seamless Contract Closure

Discovery of a potential buyer sparks the start of negotiation. Through meticulous due diligence, we balance the scales between buyer and seller interests, steering negotiations to a fair and mutually beneficial contract. Transparency is paramount, as open sharing of required information paves the way for a swift and smooth agreement.

Embarking on Change with WDC GOLF.

Letting go of a golf course is a monumental decision. With limited M&A opportunities in the market, timing is of the essence. Your proactive decision to sell is not just a personal milestone; it’s a step towards revitalizing Japan’s golf landscape and fostering a more sustainable golf industry.

At WDC GOLF, we’re here to guide you through every step, ensuring your legacy shines bright. Ready to start? Reach out for a consultation, and let’s embark on this journey together.