Why Due Diligence Matters: Approach and Importance

In the high-stakes world of M&A, due diligence is not just a step—it’s your safeguard. It’s the meticulous process that uncovers the real value behind each transaction, ensuring you’re fully aware of what you’re stepping into.

At WDC GOLF, we go beyond the basics. While lawyers and accountants play their roles, our specialized focus on the golf sector means we’re looking at what truly matters to ensure a deal that benefits everyone involved.

Our Unique Edge

In the niche field of golf course M&A, finding seasoned experts is rare. That’s where WDC GOLF stands out. Drawing from our extensive experience in organizing top-tier golf tournaments, we bring a unique perspective to every deal, understanding the intricacies of golf course management from an insider’s viewpoint.

Expert Insights from the Fairway

At WDC GOLF, we don't just facilitate deals; we're entrenched in the very fabric of the golfing world. As seasoned organizers of prestigious golf tournaments, our hands-on experience with golf course management sets us apart. This dual perspective as both operators and consultants enables us to understand the intricacies of transactions from both the seller's and buyer's viewpoints, ensuring a nuanced approach to every deal.

The Power of Connection:

What truly positions WDC GOLF ahead in the competitive landscape is our unparalleled network. Our active involvement in the golf industry provides us with direct access to a rich tapestry of golf courses throughout Japan, along with reliable, firsthand information and valuable resources. This exclusive network is not just a list of contacts; it's a gateway to opportunities that are as unique as they are lucrative.

Step 1: Initial Consultation

Everything starts with confidentiality. After signing a non-disclosure agreement, we dive deep into your needs and market possibilities. With our finger on the pulse of the M&A market, we're all about timing and precision, ensuring you're positioned for success from the get-go.

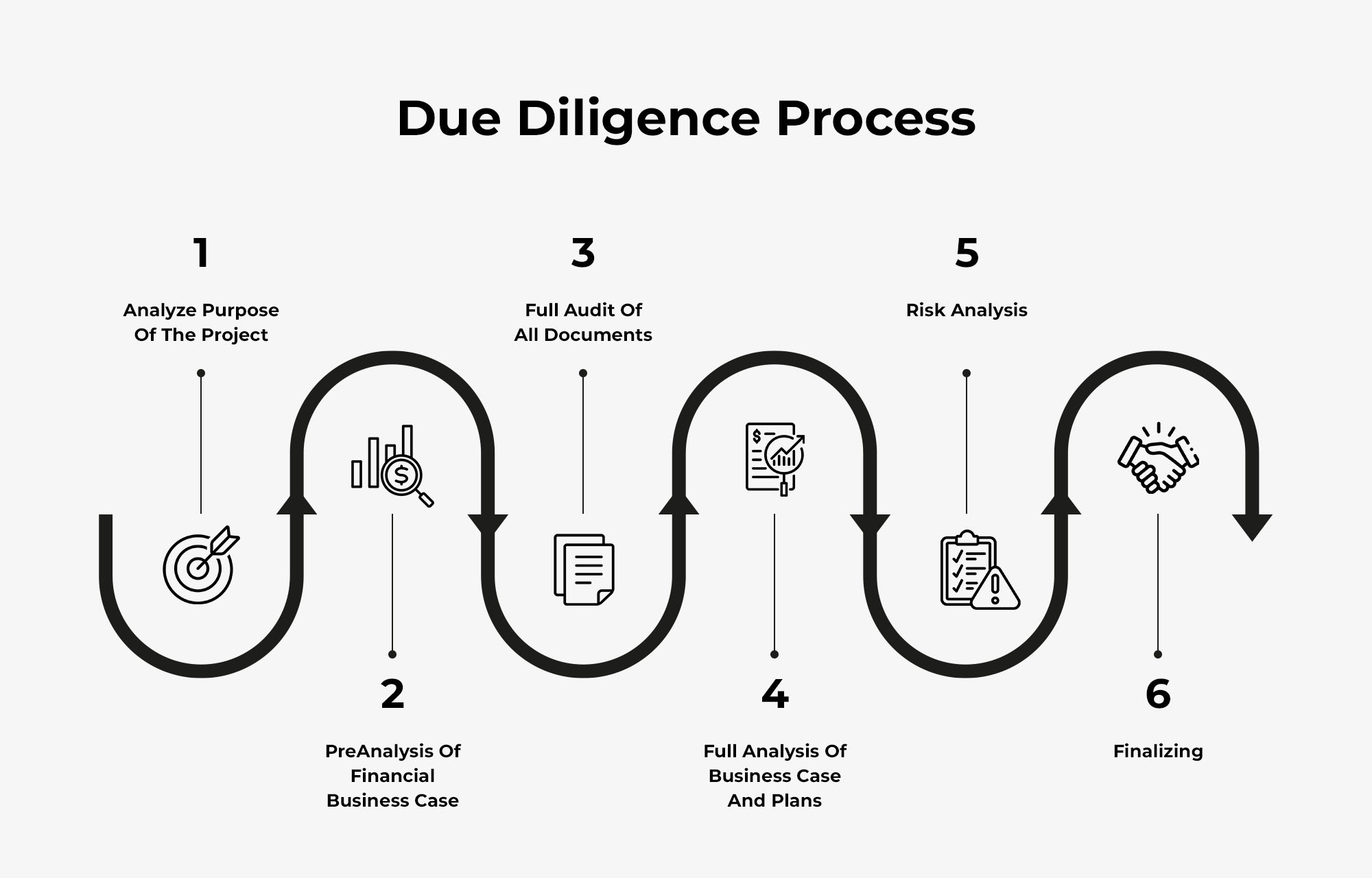

Step 2: Due Diligence Mastery

We've got due diligence down to a science. By assessing the golf course from the seller's prepared standpoint, we pivot as needed, ensuring the investment aligns perfectly with your vision and budget.

Step 3: Sealing the Deal

Negotiation is where we shine. Armed with in-depth analysis and transparent information, we aim for win-win outcomes, guiding you to a swift and satisfactory contract conclusion.

We have 20+ Golf Clubs are ready to go

Why Choose WDC GOLF?

With WDC GOLF, you’re not just getting a broker—you’re partnering with golf industry aficionados who boast a proprietary network and a track record of orchestrating the finest golf tournaments. Our approach is bespoke, our insights are unparalleled, and our dedication to your success is unwavering.

Dive into the world of golf M&A with WDC GOLF and turn your vision into a landmark achievement.